Milton-Freewater Real Estate Quarterly Update from Cascadian Real Estate

This past week felt like a sea change in the market. After 18 months of uncertainty and market adjustment, 2024 is unfortunately looking a lot like the competition of 2021 but with interest rates twice as high. Here’s what you need to know about real estate in the Walla Walla Valley as we move from winter to spring.

NAR Lawsuit

Two years ago I wrote that these cases were without merit and that we were headed down a path that could harm consumers. Now that those cases are essentially settled, I’ve updated my thoughts here.

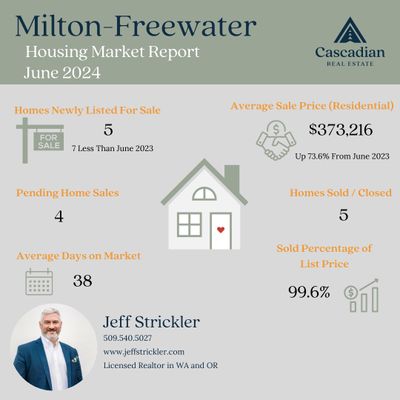

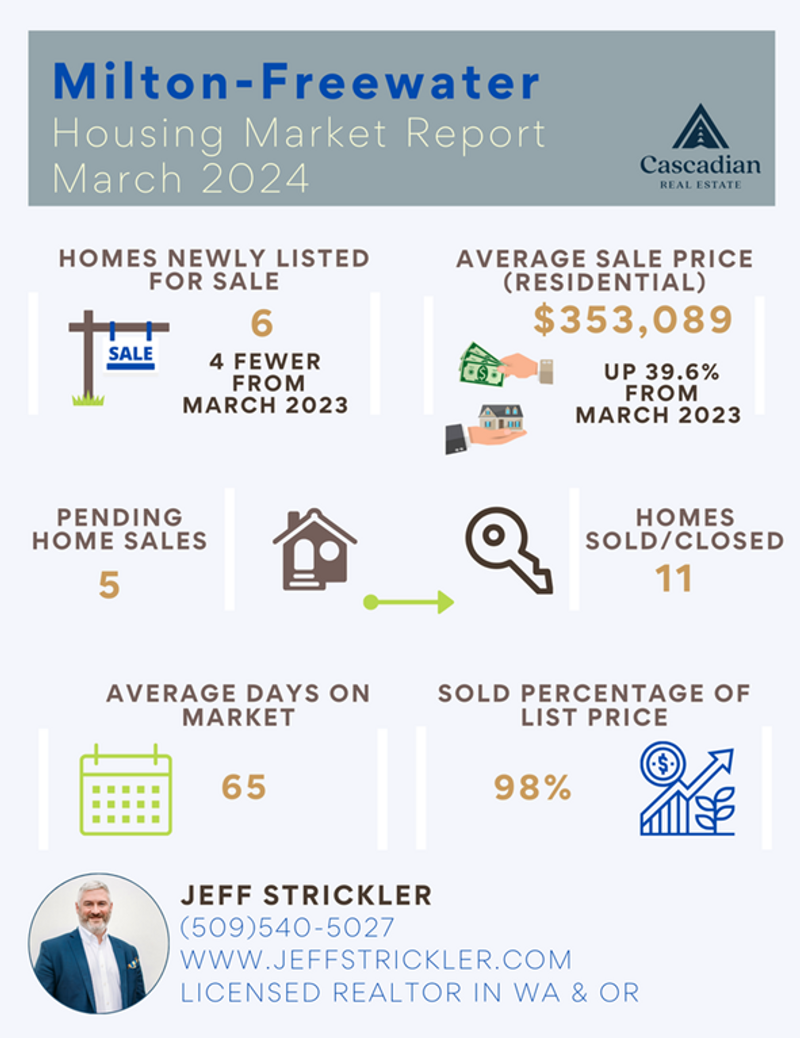

Inventory and Pricing

I’ve been told I’m the only agent in the country to make this statement: we have plenty of inventory. Unfortunately, the devil is in the details. The nuance of this is that while it is true that we have more properties on market than we’ve seen since before 2020, much of it is either grossly overpriced or undesirable and obsolete. For example, if we look at the above $800,000 market - our luxury homes - the average days-on-market is at 97, a clear indicator that prices are above market expectations. Meanwhile, at the other end of the market, homes listed below $400,000 are sitting an average of 77 days, and it’s easy to see why. The majority of these homes are in need of significant updates and repairs or have substantially obsolete floor plans (no dining area, no garage, majority of the square footage in the basement, etc).

Unfortunately, somewhere in the middle, roughly $500,000-$800,000, is where we are hurting for buyer options. Many of the homes priced higher should be down in this price range. While our area builders produce quality homes, what’s being built in this price range often lacks the amenities that our buyers want: home offices, bonus rooms, and third garage bays. Until we see more construction or agents willing to have hard conversation with overly proud sellers, buyers are going to sit on the sidelines.

Reading the Tea Leaves

Looking across analyst projections at Fannie Mae and Freddie Mac, even with three forecasted rate cuts the expectations are a drop only into the low 6% range by year end. This means buyers are likely to continue this trend of compromise and cash will remain king. Sellers are still in charge, but only so long as they price according to market demand.

Give me a call any time you’d like more information about our real estate market.Jeff Strickler: (509) 540-5027 www.jeffstrickler.com